7 Hunter io Alternatives That Find Better Email Addresses (2026)

You're looking at Hunter io alternatives because 100 million contacts isn't enough, or because credits expire monthly, or because you're paying for emails that bounce. Hunter works for basic email finding, but once you're doing serious prospecting, the limitations show up fast.

I tested 7 Hunter io competitors, running the same searches through each platform to compare what you actually get. Some have databases 3x larger than Hunter's. Some don't charge when emails come back invalid. Some let credits roll over month to month. I tracked which ones verified emails before charging credits, which ones include phone numbers, and which ones have pricing that jumps once you scale past the starter plan.

You won't find claims about which one is "best" because that depends on whether you need just emails or also phone numbers, whether you care more about database size or verification accuracy, and whether you're prospecting in the US or Europe (where data coverage varies significantly).

1. Skrapp

I'm starting with Skrapp because we built it, and I want that clear upfront. We made it to solve specific problems with email finding: charging only for valid results, letting credits roll over, and working directly with LinkedIn where most B2B prospecting happens. The platform processes about 5 million email searches daily with a 92% success rate.

What Skrapp Does

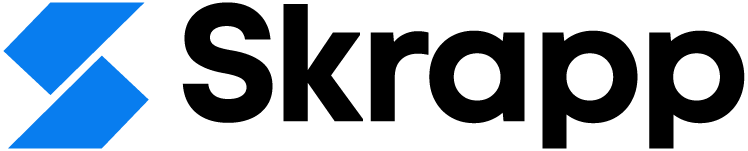

Skrapp finds and verifies business emails from LinkedIn profiles and company domains. The Chrome extension works with LinkedIn and Sales Navigator to extract contact information while you browse. You can search individual contacts or run bulk searches by uploading lists or searching entire companies.

The platform includes data enrichment features that fill in missing information for your contacts—job titles, company details, location data. The lead search function lets you filter by industry, company size, job title, and location to build targeted prospect lists. We refresh the database daily, which covers 200 million professional profiles and 20 million companies.

One feature that sets us apart is the LinkedIn auto-connect and follow functionality built into the Chrome extension. After finding an email, you can automatically send connection requests or follow prospects on LinkedIn without manual clicking. This streamlines the prospecting workflow when you're building relationships across multiple channels.

Skrapp Pricing

Free plan gives you 100 email credits monthly. Professional costs €30/month (€39 billed monthly) for 1,000 credits with 2 user seats. Enterprise runs €262/month (€349 monthly) for 50,000 credits with 15 seats, API access, and a dedicated account manager.

We don't charge credits for emails that come back as "Invalid" or "Unknown"—you only pay for verified results. Credits roll over to the next month, so you're not losing money on unused searches. This matters more than it sounds like when you're comparing actual cost per valid email across platforms.

What Users Say About Skrapp

On the Chrome Web Store, we have a 4.7 rating. Users mention the LinkedIn integration works smoothly and appreciate not being charged for bad data. One person said the email verification accuracy saves time compared to tools that return unverified emails.

The main complaints involve wanting more features like phone numbers or built-in email sequencing, which we don't offer because we focused on doing email finding well rather than becoming an all-in-one platform. Some users report occasional data gaps for smaller companies or niche industries, which is true for any database.

Best For

Skrapp works for sales teams doing LinkedIn-based prospecting who need verified emails without paying for a massive database they won't use. BDRs building targeted lists, founders doing outbound without dedicated sales teams, and SEO specialists running backlink campaigns get value from the rollover credits and no-charge policy for invalid results.

If you need phone numbers, intent data, or integrated email campaigns, you'll need to combine Skrapp with other tools or pick a different option from this list.

Key Features

- Email finder with 92% success rate across industries

- Chrome extension for LinkedIn and Sales Navigator

- Auto-connect and follow functionality for LinkedIn prospects

- Email verification with 97% accuracy using multiple validation checks

- Data enrichment for incomplete contact records

- Lead search with filtering by job title, company size, location, industry

- Company domain search for multiple employee emails

- Credits roll over monthly

- No charges for invalid or unknown results

- API access on Enterprise plan

2. Apollo.io

Apollo.io combines email finding with sales engagement features in a single platform. It's not just a Hunter alternative—it's trying to replace multiple tools in your stack by bundling prospecting, email sequences, and calling into one system. The database includes 210 million contacts and 30 million companies, which is double Hunter's size.

What Apollo.io Does

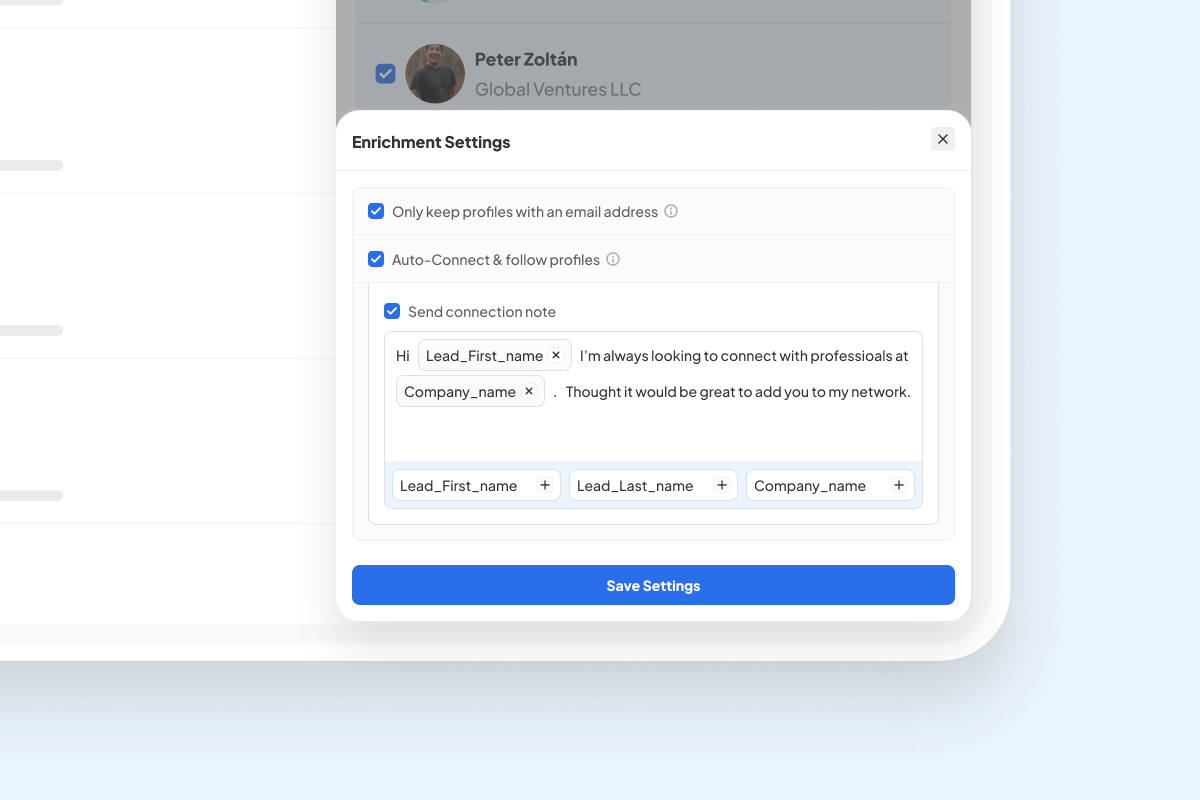

Apollo.io finds business contact information and lets you run outreach campaigns from the same platform. You can search for prospects using 200+ filters including job title, company size, industry, technologies used, and funding raised. The Chrome extension pulls contact data from LinkedIn profiles and company websites.

The platform includes seven-step email verification to reduce bounce rates. You can build email sequences with A/B testing, track opens and clicks, and set up automated follow-ups based on recipient behavior. Phone dialing and call recording features are available on higher tiers.

Apollo gives you unlimited email credits on all plans under a "fair use" policy, which sounds great until you realize mobile numbers and exports consume credits separately. One email reveal costs nothing, but accessing a phone number uses credits. This creates confusion about actual costs when you're prospecting with multiple data points.

Apollo.io Pricing

Free plan includes unlimited email credits (fair use applies) with 10 export credits monthly. Basic costs $49 per user monthly (annual billing) or $59 monthly with 5,000 credits. Professional runs $79 per user monthly (annual) or $99 monthly with 10,000 credits. Organization tier costs $119 per user monthly (annual) or $149 monthly with 15,000 credits and requires minimum 3 users.

The per-user pricing adds up fast when you're scaling a team. Additional credits cost $0.20 each with a 250-credit minimum purchase. The unlimited emails work for email-only prospecting, but if you need phone numbers regularly, budget for significant credit purchases beyond the base plan.

What Users Say About Apollo.io

Users praise the all-in-one approach and mention the interface is straightforward once you learn it. One person noted "The integration with all my mailboxes is seamless, and the platform is user-friendly."

Complaints focus on data accuracy issues, particularly with mobile numbers that turn out to be incorrect. Some users report deliverability problems with emails sent through Apollo's infrastructure. The credit system frustrates people who get charged even when data comes back wrong. On Reddit, discussions mention Apollo works better for US markets than international prospecting.

Best For

Apollo.io works for small to medium businesses that want prospecting and outreach in one platform. If you're currently using separate tools for finding contacts and running email campaigns, consolidating to Apollo reduces software costs despite the per-user pricing.

Teams focused on US market prospecting get better results than those targeting Europe or Asia where data coverage thins out. If you need reliable mobile numbers or are doing high-volume international prospecting, other tools on this list handle those use cases better.

Key Features

- 210+ million contacts and 30+ million companies in database

- Unlimited email credits under fair use policy

- Chrome extension for LinkedIn and website prospecting

- Email sequencing with A/B testing and automation

- Seven-step email verification process

- 200+ search filters including technographics

- Phone dialing and call recording (higher tiers)

- Buyer intent data for identifying ready-to-buy accounts

- AI writing assistant for email drafting

- Integrations with Salesforce, HubSpot, and other CRMs

3. Lusha

Lusha focuses on providing both email addresses and phone numbers with higher accuracy than most email-only tools. The platform emphasizes phone number verification, claiming 90% accuracy for mobile numbers compared to industry averages around 70-75%. This matters if you're running call-heavy prospecting campaigns where bad phone data wastes hours.

What Lusha Does

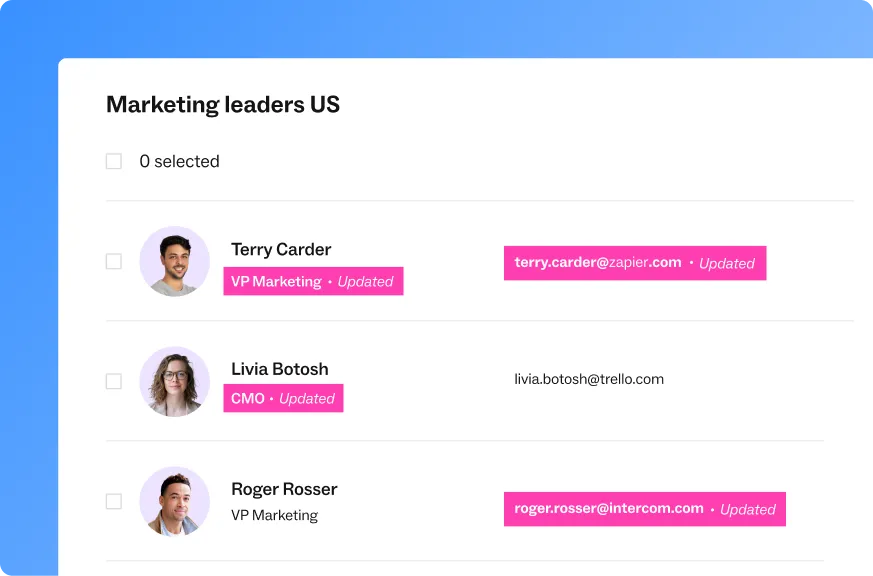

Lusha finds verified email addresses and direct dial phone numbers for B2B contacts. The Chrome extension works with LinkedIn, Facebook, Twitter, Salesforce, and company websites to reveal contact information while you browse. You can enrich existing contact lists by uploading CSV files for bulk data enhancement.

The platform includes intent data and job change alerts that notify you when contacts move to new companies—a good trigger for outreach. CRM integrations with Salesforce, HubSpot, and Pipedrive sync data automatically. The AI Chat feature builds prospect lists based on natural language queries rather than complex filter combinations.

Lusha maintains GDPR and CCPA compliance, which matters if you're prospecting in regulated markets. The platform claims 95% email deliverability, though that number reflects verified emails, not the full database accuracy.

Lusha Pricing

Free plan offers 70 credits monthly with basic features. Pro costs $36 per user monthly with 24,000 emails per year and 480 phone numbers. Premium runs $51-$59 per user monthly with priority support. Scale plan has custom pricing for enterprise needs.

The credit system uses 1 credit per email but 10 credits per phone number. This means your credits burn 10x faster when accessing phone data. On monthly plans, unused credits roll over and accumulate up to twice your plan limit, which helps if your prospecting volume fluctuates.

What Users Say About Lusha

Users consistently mention phone number accuracy as Lusha's strength. One sales team said "Most of my meetings I get now, I get thanks to Lusha. Out of 10 meetings, 7 are booked with Lusha."

The main complaint centers on the 10-credit cost for phone numbers making it expensive to build call lists. Some users in niche industries report data accuracy drops for specialized roles or smaller companies. On Reddit, people mention Lusha works well for common job titles at larger companies but struggles with unique roles at startups.

Best For

Lusha works for sales teams running multi-channel outreach where phone calling is a primary tactic. If you're only using emails, the 10-credit phone number cost doesn't matter. If you're building call lists regularly, budget for burning through credits quickly.

Teams targeting common roles at mid-to-large companies get better coverage than those prospecting at small businesses or in niche industries. Recruiters needing to reach passive candidates on multiple channels find value in the phone number accuracy.

Key Features

- 280+ million verified B2B contacts

- 90% phone number accuracy for direct dials

- 95% email deliverability rate

- Chrome extension for LinkedIn and multiple platforms

- Bulk enrichment via CSV upload

- Intent data and job change tracking

- CRM integrations with Salesforce, HubSpot, Pipedrive

- AI Chat for natural language prospect list building

- GDPR and CCPA compliant

- Credits roll over up to 2x plan limit

4. ZoomInfo

ZoomInfo operates at enterprise scale with pricing to match: starting at $14,995 annually. The platform includes 320 million contacts and 100 million companies with continuous data updates. It's not just a Hunter alternative; it's a complete go-to-market intelligence system with sales, marketing, operations, and talent acquisition modules.

What ZoomInfo Does

ZoomInfo provides business contact data alongside buyer intent signals, technographic information, and company intelligence. The SalesOS module handles contact search with advanced filters and real-time intent data showing which companies are actively researching solutions. MarketingOS runs account-based marketing campaigns with cross-channel advertising and website chat.

The OperationsOS module cleans and deduplicates data across your systems. TalentOS helps with recruiting. The recently launched Copilot uses AI to create buying groups, generate account summaries, and write personalized emails based on company research and contact behavior.

ZoomInfo claims 95% data accuracy, though independent verification of that number is difficult. The platform excels at North American business data but coverage thins for international markets. Intent data identifies companies showing buying signals based on web behavior and content consumption.

ZoomInfo Pricing

Professional plan starts at $14,995 annually with 5,000 credits and supports 3 users. Advanced costs $24,995 per year with 10,000 credits plus 1,000 monthly credits per user. Elite runs $39,995 annually with premium support and highest data access. Additional users cost $1,500-$2,500 each depending on plan tier.

Credits cover contacts and company exports. Even technographic information consumes credits, which adds up when you're researching accounts. Volume discounts apply for larger teams, but you're still looking at enterprise-level investment regardless of team size.

What Users Say About ZoomInfo

ZoomInfo ranks in the top 0.01% of vendors on G2 with 138 number-one rankings. Users praise data accuracy and depth of company intelligence. One person mentioned it provides "unparalleled insight into target accounts."

On Trustpilot, reviews turn considerably more negative. Multiple complaints about difficulty correcting inaccurate information, rigid contract terms, and customer service problems. Some users mention being locked into annual contracts when data quality didn't meet expectations. The split between G2 (positive) and Trustpilot (negative) suggests satisfaction varies significantly by use case and company size.

Best For

ZoomInfo makes sense for enterprise organizations with budgets above $20,000 annually for sales intelligence. If you need advanced intent data, detailed firmographic information, and you're running account-based marketing campaigns, the investment can pay off through targeting precision.

Small teams, solo founders, and companies that need basic contact information won't get value proportional to the cost. The platform requires dedicated users to extract maximum value—it's not a tool you occasionally dip into for contact searches.

Key Features

- 320+ million contacts and 100+ million companies

- 95% claimed data accuracy

- AI-powered Copilot for buying groups and personalized outreach

- Buyer intent data showing active research behavior

- Technographic data on company technology usage

- Website visitor identification and tracking

- SalesOS, MarketingOS, OperationsOS, TalentOS modules

- Advanced filtering with detailed firmographic data

- CRM integrations with Salesforce, HubSpot, and others

- Chrome extension for LinkedIn and web prospecting

5. Snov.io

Snov.io sits somewhere between a lead finder and a full outreach platform. It’s one of the oldest Hunter.io competitors and still popular with small sales teams because it bundles email discovery, verification, and cold email automation in one dashboard. The tradeoff is that pricing gets layered quickly once you start adding credits or automation tools beyond the base tier.

What Snov.io Does

Snov.io finds and verifies professional email addresses from domains, company lists, or LinkedIn profiles through its Chrome extension. It also includes a built-in email campaign tool that sends and tracks sequences directly from your connected inbox. Users can add custom variables for personalization and automate follow-ups based on replies or engagement data.

The platform’s database covers about 200 million contacts, smaller than Apollo or Seamless.AI, but the integrated email verifier keeps bounce rates lower than bulk scrapers. You can also enrich existing lists by uploading CSV files to fill missing data such as company size, location, or industry. For teams managing outreach inside CRMs, Snov.io connects to HubSpot, Pipedrive, and Salesforce via native integrations.

Snov.io Pricing

Snov.io’s free plan offers 50 monthly credits and 100 drip emails. Paid tiers start at $39/month for 1,000 credits and rise to $99/month for 5,000 credits. Email-sending automation adds extra cost—most users end up paying 2–3× the base price once they include LinkedIn automation or higher send volumes.

What Users Say About Snov.io

Users on G2 (4.5/5 average) like its clean interface and steady verification accuracy. Reddit discussions highlight that it’s stable for small teams but becomes expensive when scaling campaigns or multiple domains. A few reviewers mention slower verification times during peak hours, especially when bulk uploading large lists.

Best For

Snov.io fits startups or solo SDRs who want one tool to find and send emails without juggling multiple platforms. If you only send a few hundred cold emails a week, the all-in-one model saves setup time. For higher volumes or multi-domain operations, Smartlead or Instantly.ai scale more efficiently.

Key Features

- Domain, company, and LinkedIn email finder

- Built-in email sequencing with open and reply tracking

- Real-time email verification system

- CRM integrations with HubSpot, Salesforce, Pipedrive

- 200M+ contact records

- Custom variables and personalization options

- Bulk enrichment via CSV upload

- Chrome extension for LinkedIn

- Team collaboration features on paid tiers

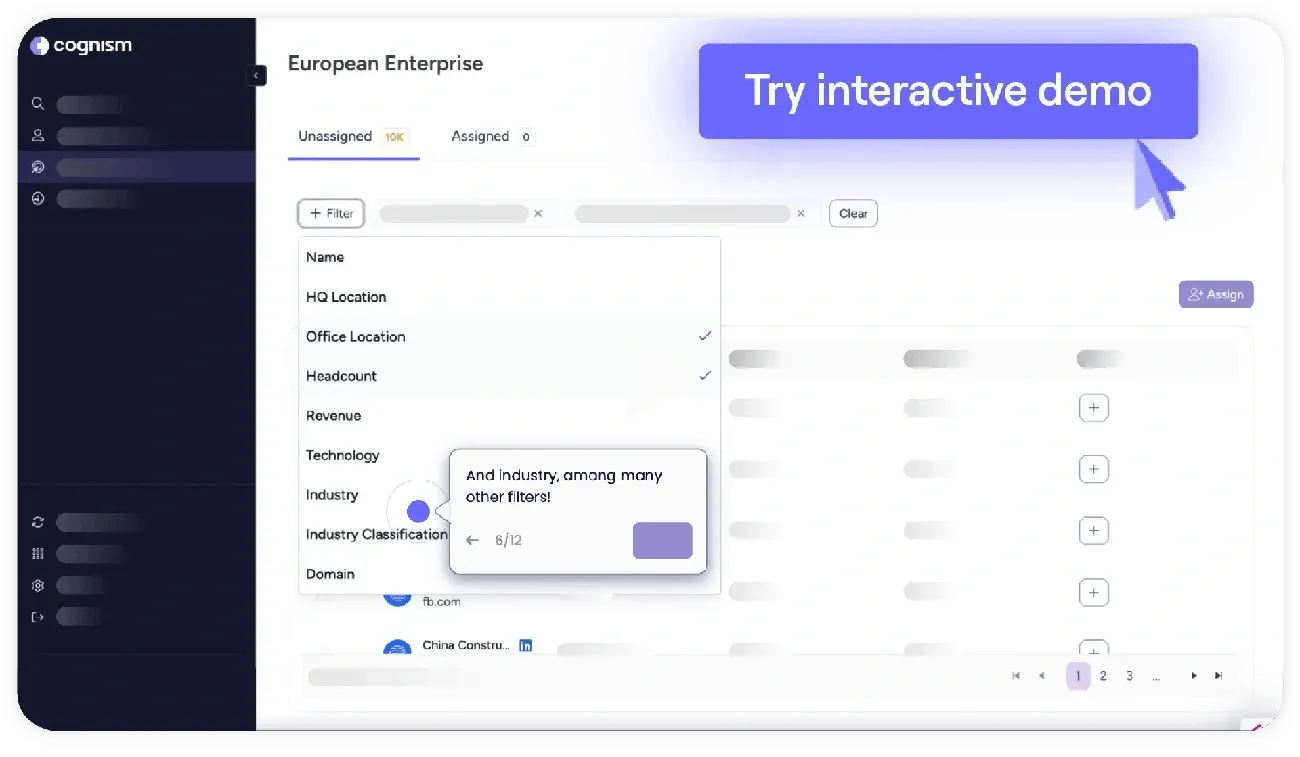

6. Cognism

Cognism focuses on verified mobile numbers and compliant data rather than raw volume. It’s one of the few tools that manually checks phone numbers through live verification, which makes it stand out for teams that rely on calling as much as emailing. The database is smaller than Seamless.AI or ZoomInfo, but the accuracy on mobile numbers is noticeably higher, especially in Europe.

What Cognism Does

Cognism finds business emails and direct-dial phone numbers, then verifies them through a mix of automation and human validation. Its Diamond Data system uses real people to confirm mobile numbers, so connection rates tend to be stronger than with fully automated tools. It also includes intent data, job-change alerts, and CRM integrations that automatically update contact records when someone switches companies.

The platform is fully GDPR- and CCPA-compliant, with ISO 27001 certification. That matters for teams working in or with clients in regulated regions. Unlike database scrapers, Cognism updates and validates records continuously rather than relying on static lists refreshed once a quarter.

Cognism Pricing

Cognism doesn’t list prices publicly, but most teams report annual contracts starting around $15,000–$18,000, depending on user count and data access. Credits are shared across the team and used for exports or mobile numbers. Enterprise packages add custom integrations, API access, and dedicated account support.

What Users Say About Cognism

Users mention strong accuracy on mobile numbers and quick customer support responses. Reviews on G2 (4.6/5 average) often highlight improved connect rates after switching from ZoomInfo or Lusha. Complaints mostly focus on the high entry price and the need for a sales call before getting a quote. Reddit threads mention the data quality is best in the UK and Western Europe but less consistent in smaller markets.

Best For

Cognism fits sales teams that make live calls or need to stay fully compliant under GDPR. If you’re working in EMEA or calling prospects directly, the verified mobile data can justify the higher cost. For US-based email-heavy outreach, tools like Skrapp or Smartlead will cover most needs at a fraction of the price.

Key Features

- Human-verified Diamond Data mobile numbers

- GDPR, CCPA, and ISO 27001 compliance

- Real-time intent signals and job-change tracking

- CRM integrations with Salesforce, HubSpot, and Pipedrive

- Contact enrichment for existing databases

- Automatic record updates when contacts move companies

- Focused European data coverage

- Continuous data validation to maintain accuracy

7. Seamless.AI

Seamless.AI leans on scale over precision. It constantly crawls the web to pull in new contact data, which helps it claim one of the largest databases in the industry, but that also means accuracy can vary depending on industry and region. It’s the kind of tool that suits teams sending thousands of cold emails daily rather than those who need every record to be perfect.

What Seamless.AI Does

Seamless.AI generates emails and phone numbers in real time by scanning public web sources instead of relying on a fixed, prebuilt database. The Chrome extension works directly on LinkedIn, Salesforce, and company websites, showing contact info as you browse. It supports large-scale list building and exports directly into CRMs like HubSpot, Zoho, and Outreach.

You can filter contacts by company size, department, and seniority, and the platform adds a basic AI layer to score leads by relevance. Because data is gathered dynamically, you’ll often get fresh results that didn’t exist in the database before—but they’re not always verified, so quality can fluctuate.

Seamless.AI Pricing

There’s a free plan with 50 monthly credits. Paid tiers start around $147/month per user for Pro, with “Unlimited” access available only through custom quotes. Users often report that “unlimited” isn’t truly unlimited—after about 1,000 lookups a day, the system slows down or caps results.

What Users Say About Seamless.AI

Reviews on G2 (4.3/5) mention how useful the Chrome extension is for LinkedIn prospecting and how fast the platform pulls large lists. Common complaints are around billing transparency and variable accuracy—some users say it’s excellent for enterprise data, while others report high bounce rates for small-company contacts. Reddit discussions also mention aggressive upselling once the free trial ends.

Best For

Seamless.AI fits teams that care more about quantity than precision. It’s handy for quickly building large prospect lists or populating CRMs for cold outreach testing. If your workflow depends on accurate or compliant data, though, you’ll spend time cleaning what Seamless pulls in—making tools like Skrapp or Cognism better long-term fits.

Key Features

- 1.8B+ email addresses and 200M phone numbers

- Real-time web crawling for up-to-date contacts

- Chrome extension for LinkedIn, Salesforce, and websites

- Bulk list building and CRM exports

- AI-based lead scoring

- Integrations with HubSpot, Outreach, Zoho, Salesforce

- Free plan with 50 credits

- Inconsistent verification for smaller companies or non-US data

How These Hunter.io Alternatives Compare on Key Trade-Offs

| Credit Expiry Policies |

Hunter.io credits reset monthly with no rollover.

Skrapp: Credits carry over to the next month. Apollo.io: Uses a fair-use model with unlimited email credits. Lusha: Unused credits can roll over, up to 2× your plan limit. Snov.io: Unused credits expire each month with no rollover. |

|---|---|

| Charges for Invalid Data |

How each tool handles bad or missing results impacts your real cost per valid email.

Hunter.io: Charges a credit even when no email is found. Skrapp: Doesn’t charge for “Invalid” or “Unknown” results. UpLead: Only bills for verified addresses; refunds instantly for invalids. Saleshandy: No charge if Lead Finder fails to locate a valid email. |

| Phone Number Availability |

Hunter.io focuses purely on email, but several rivals include phone data.

Cognism: Diamond Data® with manually verified mobile numbers. Lusha: 10 credits per phone number versus one for an email. ContactOut: 100M phone numbers with 99% confidence rating. ZoomInfo: Direct dials included, though at higher cost tiers. |

| Core Value Focus |

Each platform leans toward a distinct strength:

Skrapp: Verified emails directly from LinkedIn with rollover credits. Cognism: Compliance-first data and strong European accuracy. ZoomInfo: Enterprise-level database with intent and technographic insights. Apollo.io: Combines prospecting and outbound automation. Seamless.AI: Large-scale, continuously updated web-scraped data. |

| Database Size & Accuracy |

Bigger isn’t always better—quality and verification depth vary:

ContactOut: 350M professionals, 200M verified emails, 100M phones. ZoomInfo: 320M+ contacts, 95% claimed accuracy. Apollo.io: 210M+ contacts; accuracy depends on region and role. Cognism: Smaller database but higher verified phone accuracy. |

| Pricing Models |

The cost structure matters as much as the sticker price:

Per-credit: Hunter.io, Skrapp, UpLead. Per-user: ZoomInfo, Apollo.io. Mixed: Lusha (credits assigned per seat). Annual contracts: Cognism and ZoomInfo start around $15K–$20K per year. |

What Hunter.io Alternatives Make the Most Sense?

You’ve seen how each Hunter.io alternative tackles the same problem differently. The real question isn’t “which is biggest?” — it’s which one fits the way you actually prospect.

If you’re doing most of your outreach on LinkedIn, Skrapp is the most logical move. It’s built around LinkedIn workflows, verifies every email before charging a credit, and rolls unused credits forward — something Hunter still doesn’t do. Kaspr also focuses on LinkedIn data but has some ongoing privacy debates that make Skrapp the safer long-term pick.

If you rely on phone numbers or outbound calling, tools like Lusha and Cognism are built for that. Lusha’s data accuracy is strong, though its 10-credit cost per phone number adds up quickly. Cognism’s Diamond Data is verified manually and performs best in the UK and wider European markets.

If your outreach needs to stay GDPR-compliant or you target Europe, Cognism stands out again for compliance and verified phone data, while Dropcontact deserves mention for its algorithmic approach that never stores personal data.

If you prefer an all-in-one system that handles prospecting and outreach, Snov.io and Apollo.io fit that category. Snov.io keeps things simpler with built-in sequencing and real-time verification, though costs climb once you start automating at scale. Apollo.io combines data and outreach in one dashboard but can get expensive for teams once extra credits and users are added.

If you care about scale and automation, Seamless.AI offers large data coverage but needs list cleanup, while ZoomInfo provides deeper insights for teams with enterprise budgets. Seamless’s advantage is volume; ZoomInfo’s is depth — but neither competes with Skrapp on cost efficiency or ease of use for smaller teams.

If you’re working with a limited budget, the best combination of accuracy, pricing, and fair billing still comes from Skrapp. You’re not paying for guesses, you’re not losing unused credits, and you’re not locked into a heavy annual contract. It’s a straightforward system that works for real-world prospecting — especially if your team sources directly from LinkedIn or Sales Navigator.

The takeaway:

- Use Skrapp for verified LinkedIn-based prospecting with fair pricing.

- Use Cognism or Lusha when direct dials or compliance are critical.

- Use Snov.io or Apollo.io if you need built-in outreach tools.

- Use ZoomInfo only if you’re operating at enterprise scale.

The right choice depends on what your workflow looks like on a normal day, not in a demo. Run the same small batch of searches across a few tools, check the results, and see which one gives you verified, usable data every time.

FAQs: Hunter io Alternatives

Is there a better, more accurate AI tool than Hunter io for finding emails?

Yes, especially if you want the best possible combination of accuracy and value. For most B2B prospectors, the best starting point is Skrapp. We prioritize verification, and the AI works to ensure you're only charged for a valid email, not just a guess. If you need full, integrated AI search, tools like Seamless AI and Apollo io offer more features, but you must accept the trade-off in data consistency.

How is data accuracy verified, and should I trust the 95% claims?

You should be skeptical of any high accuracy claim unless the company backs it up with its billing policy. Every tool uses web scraping, but the real test is the verification step. The best policy is ours: Skrapp doesn't charge you a credit for an email that comes back as 'Invalid' or 'Unknown.' If you need an explicit guarantee, UpLead offers a 95% accuracy guarantee, which is a rare commitment in this market.

Which tools are the cheapest alternatives, and what do I give up for the lower price?

The cheapest reliable alternative for email prospecting is one that makes your credits last. This means prioritizing Skrapp. Our low-cost plans offer the best value because credits roll over, and we never charge you for bad data, making your budget stretch significantly further than on platforms with restrictive monthly limits. For that low price, you are giving up phone numbers and intent data.

Which tool offers the best balance of email accuracy and database size for scaling a team?

The cheapest reliable alternative for email prospecting is one that makes your credits last. This means prioritizing Skrapp. Our low-cost plans offer the best value because credits roll over, and we never charge you for bad data, making your budget stretch significantly further than on platforms with restrictive monthly limits. For that low price, you are giving up phone numbers and intent data.

How do credit policies differ, and why should I care about credit rollover?

You should care because paying for a search that gives you a bad email is wasted money. This is where Skrapp's policy gives you the biggest advantage:

- The Best Policy (Skrapp): We only charge a credit for a valid, usable result, and your unused credits roll over month-to-month. This is the most budget-friendly approach.

- The Guarantee Policy (UpLead): They refund credits for bad data, which is excellent.

- The All-In-One Policy (Apollo/Seamless): They may give "unlimited" emails with paid plans, but this usually comes with lower accuracy, putting your sender reputation at risk.

Always check the fine print: Do credits expire, and are you charged for invalid data? This tells you everything about a company's confidence in its data.